There was a significant increase in the value of Australia inbound M&A during the first nine months of the year.

For the first three quarters of the year, the total value of inbound M&A to the country was $60.8bn, up 27.5% from the $47.7bn of the first three quarters of 2016, according to data from Mergermarket.

This comes despite a slowdown in the third quarter, when the value of inbound M&A totalled $15bn, which is lower than the $19.8bn recorded in the same period of 2016.

However, the total is lower than the $71.4bn recorded in the first three quarters of 2015, which was a record year for the last five years.

The energy, mining, and utilities sector was the top sector in terms of deal value with $34.3bn worth of deals in the first nine months of the year. It was followed by the financial services ($7bn); business services ($4.9bn); pharmaceutical, medical, and biotechnology ($4.5bn); and consumer ($3.9bn) sectors.

Mergermarket also took note of an increase in private equity activity, with these firms involved in 46 deals valued at $13.8bn so far this year, compared to 41 deals valued $13.9bn in the same period last year.

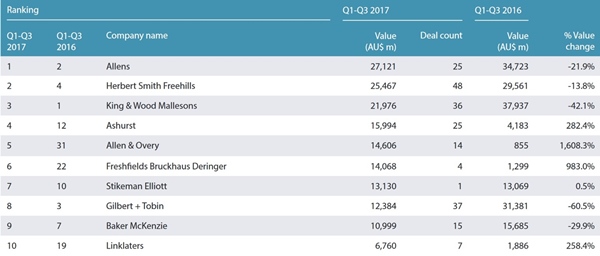

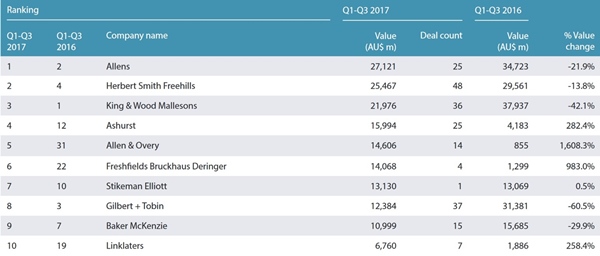

Top legal advisors

The third quarter of the year saw Australia’s top law firms change places in Mergermarket’s league tables.

Allens topped all other firms in terms of deal value.

Herbert Smith Freehills placed first in terms of deal count.

Top legal advisers by deal value

Source: Mergermarket

Top legal advisers by deal volume

Source: Mergermarket

Top legal advisers by deal volume

.jpg) Source: Mergermarket

Related stories:

Australasian M&A on the rise

US firms dominate global M&A as businesses make fewer – but bigger – deals

Source: Mergermarket

Related stories:

Australasian M&A on the rise

US firms dominate global M&A as businesses make fewer – but bigger – deals

.jpg)