Public confidence in New Zealand’s capital markets is rising, according to a poll last month by the Financial Markets Authority (FMA), and part of the reason may be a better legal framework.

Almost 70 percent of middle income earners surveyed described themselves as confident, up 13 percentage points since last year. The more upbeat mood suggests that the relatively strong performance of the NZX over the last 18 months and high KiwiSaver participation rates have begun to unwind the legacy of distrust created by the 1987 share market crash and by the 2006 to 2010 finance company collapses.

But there is also a regulatory explanation. The small or non-expert investor in New Zealand can now look forward to a much more sympathetic and supportive regulatory environment than previously.

Tough new regulations against unsolicited offers are forcing much higher levels of transparency and have chased at least one low ball offeror from the market.

And further improvements are on the way through the progressive implementation of the Financial Markets Conduct Act (FMCA). The FMA survey found that only half (53 percent) of investors considered the materials they received about their investments were helpful in making an informed decision – a result FMA Chief Executive Rob Everett said was “consistent with other feedback we’ve received”.

Phase 2 of the FMCA, to come into force on 1 December this year, should deal to this problem as it will introduce a number of changes designed to make it easier to compare one financial product against another and to make offer documents more user-friendly and accessible.

Product Disclosure Statements (PDS) will need to meet the “clear, concise and effective” standard prescribed in the FMCA. They will also have to be headed by a Key Information Summary (KIS), which must be no more than two to four pages, depending on the product type.

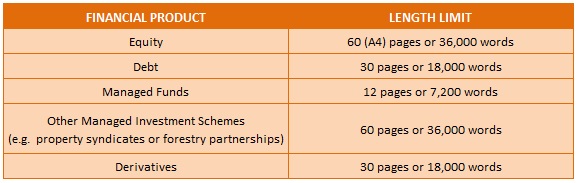

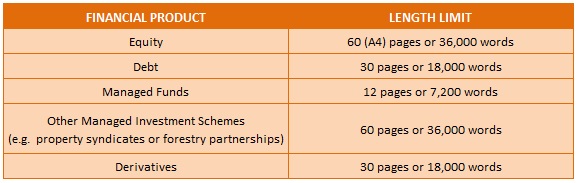

PDSs themselves will be subject to strict page or word limits. The proposals in the table below are currently being consulted on.

The FMCA also catches the law up with technology. It does this by:

- creating an online register to which PDSs will be posted along with supplemental material for interested investors and analysts. The register will be designed to aid the comparability of offers and to allow for the cost-effective updating of data by issuers, and

- enabling crowd funding and Peer to Peer internet formats to become “licensed intermediaries” – a status which allows them to be used to issue shares or raise money from the public without having to supply a full PDS.

Simplified disclosure processes are also available for: small, personalised offers (no more than 20 investors and no more than $2 million in any 12 month period), employee share purchase schemes (for up to 10% of the company’s capital base) and simple bank products.

No PDS will be required for equity securities which are already traded on the NZX (e.g. rights issues, dividend reinvestment and other same class offers) and where the only change to an existing debt security is the interest rate or maturity date.

The main purposes of the Act are to promote fair, efficient and transparent financial markets and to promote the confident and informed participation of businesses, investors and consumers in those markets.

Additional purposes are to avoid unnecessary compliance costs and to promote innovation and flexibility. While the Act adds considerable additional regulatory compliance, in most cases it is warranted. A broader range of exemptions has also been introduced to cover situations where more limited compliance is appropriate.

The Act covers a lot of ground, replacing five Acts and parts of a sixth Act, and introducing a number of fundamental changes in regulatory design:

- a shift to regulating products according to their economic substance rather than their legal form (for example, a redeemable preference share is treated as a debt security rather than an equity)

- a shift from regulating only those securities which are offered to the public to a system in which all offerings are regulated unless specifically exempt

- simplified securities advertising rules

- creation of a collective investment scheme framework under which all schemes must comply with a common set of substantive requirements, including on-going disclosure provisions

- a licensing framework for certain financial market participants, including derivatives issuers, fund managers, discretionary investment managers, certain intermediaries and financial product market operators

- wider regulation of financial product exchanges with flexibility around the rules to accommodate different markets and to encourage the development of a ‘stepping stone’ exchange for smaller companies

- civil liability and sanctions focused on compensation for loss rather than strict liability offences

- infringement notices for lesser offences, and the possibility of jail time for egregious breaches, such as where the conduct in question involved knowledge or recklessness.

Four categories of financial product are defined within the Act. They are, in order, debt securities, equity securities, managed investment products and derivatives.

The FMA as regulator has the power to categorise products, re-designate a product from one category to another as appropriate and ‘call in’ a security which might otherwise, or may have been designed to, escape the net (for example, a property investment scheme could be brought into the Act even if structured as an investment in land).

The Act owes much of its quality to the excellent process which went into its formation and development. There have been many opportunities for input, including an FMA-hosted “talk to us” website and twitter account to invite participation on the regulation-making phases.

Penny Sheerin

Penny Sheerin is a partner at Chapman Tripp, specialising in securities law, financial services regulation and funds management.