Chapman Tripp has won the distinction of being the only New Zealand-headquartered law firm to enter the top 15 of Mergermarket’s Australasia league tables for 2016.

According to Mergemarket’s report, the top firm acted on 18 deals with a total deal value of more than US$10.83 billion, or about $15.17 billion.

The law firm says M&A activity last year was “robust,” fuelled by strategic takeovers and Chinese interest in New Zealand investment. The firm has a bullish outlook on M&A in New Zealand for this year.

“As anticipated, it was a strong finish to a year of robust M&A activity; the hallmarks of which included strong strategic takeover activity, steady and significant Chinese direct investment into New Zealand, improved Overseas Investment Office (OIO) consent process and a pick-up in private M&A activity,” said Tim Tubman, head of the firm's corporate practice.

“While international uncertainties such as Brexit and Trump may affect M&A levels globally in 2017, New Zealand companies are still showing a healthy appetite for deals, so we expect to see larger deal volumes continue in the first half of 2017,” he added.

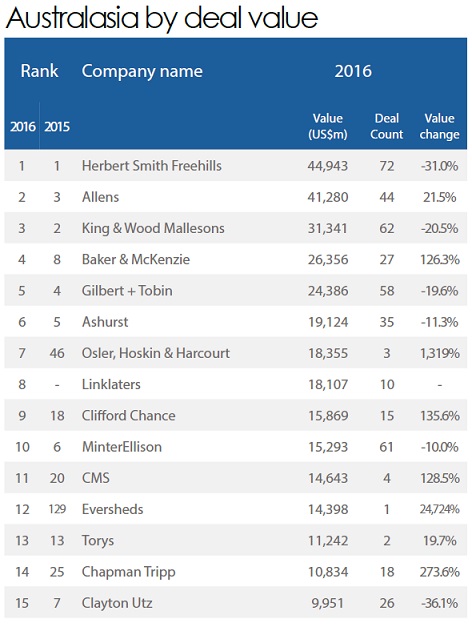

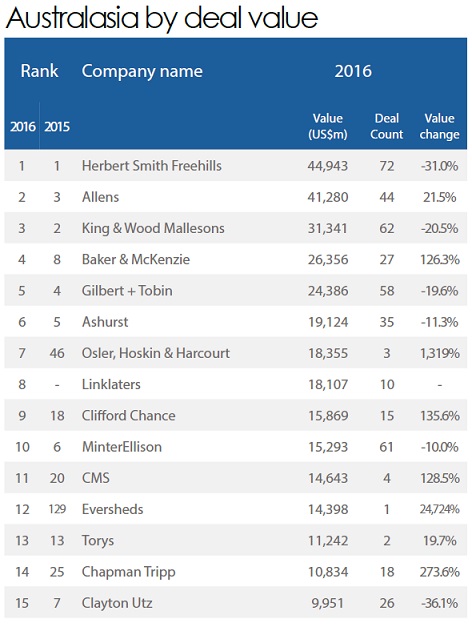

Ranked first in the deal value list was

Herbert Smith Freehills with deals worth US$44.94 billion or about $62.93 billion, followed by

Allens with deals worth US$41.28 billion, and King & Wood Mallesons with US$31.34, or about $43.89 billion.

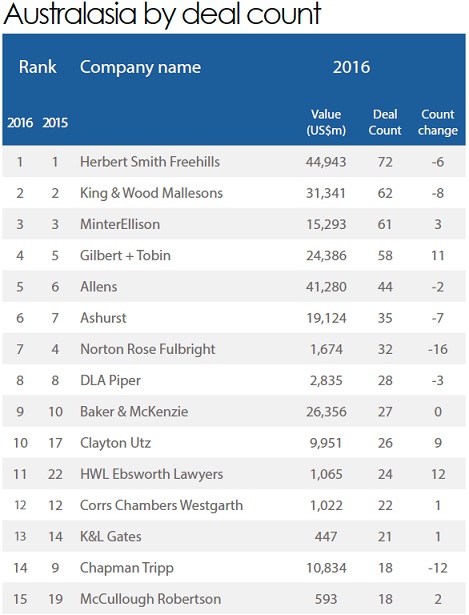

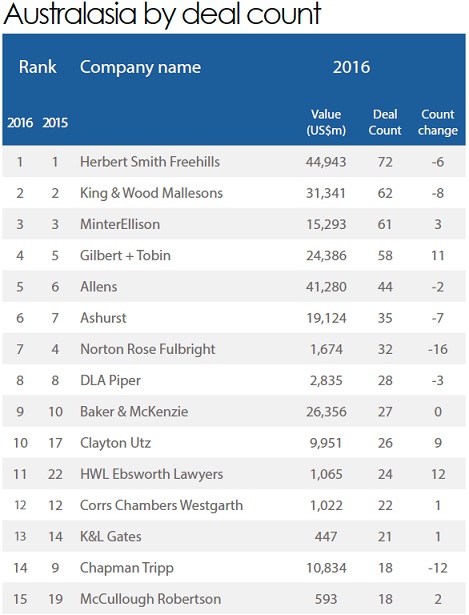

In terms of deal count, HSF also took the top spot with 72 deals, followed by KWM with 62 deals and MinterEllison with 61 deals worth US$15.29 billion or about $21.41 billion.

The full league tables can be seen below:

Source: Mergermarket

Source: Mergermarket

Related stories:

Lone non-US headquartered firm in Q4 Global M&A League Tables top 10

Here are the 15 firms with the biggest deal values in Australasia for 2016